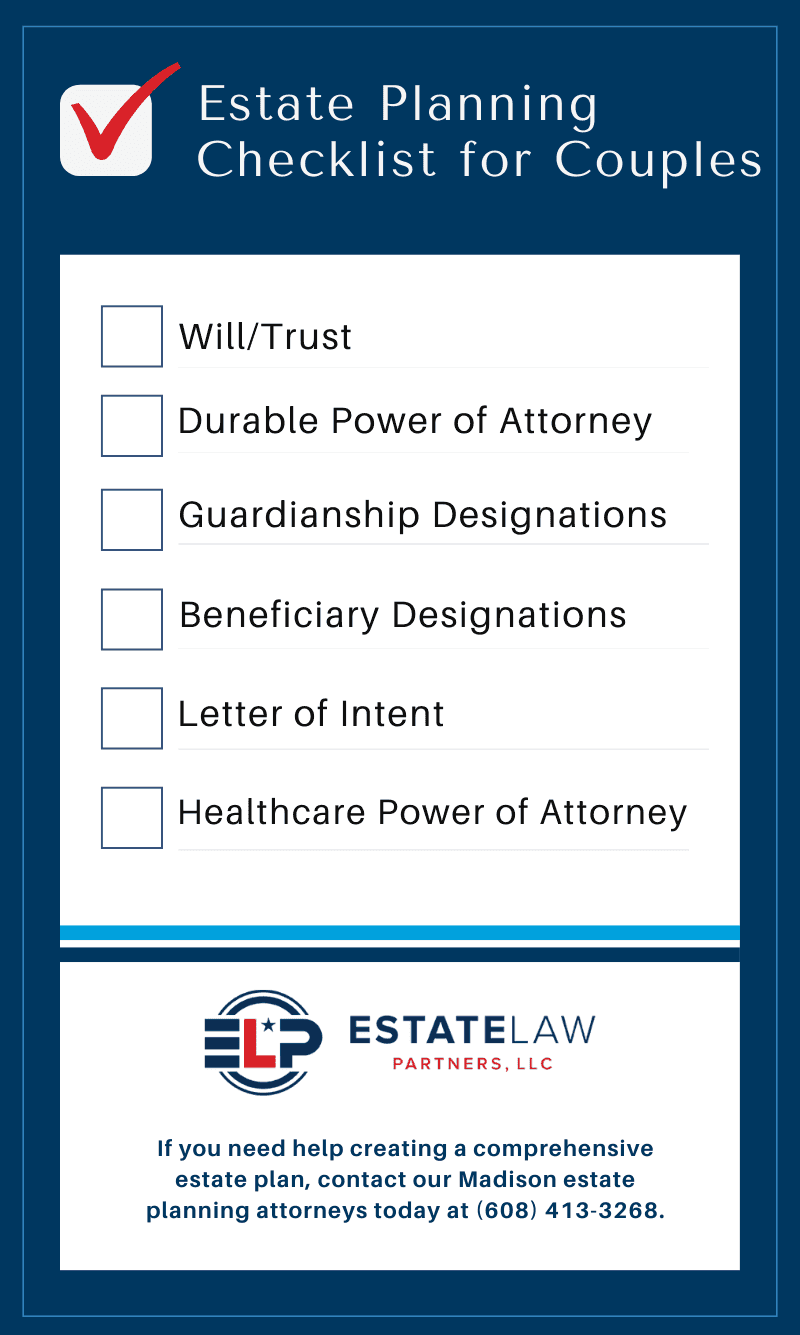

Creating an estate plan doesn’t only consist of drafting a will or a trust. There is much more that couples should include so that their estate plan will protect their assets and their loved ones. Developing the best estate plan can be an overwhelming process–especially for couples. Thankfully, our Madison estate planning attorneys have put together a checklist to help couples gather the documents needed to protect their best interests.

If you need help creating a comprehensive estate plan, our team at Estate Law Partners, LLC is here to help you. Contact us today at (608) 292-5185 to schedule a consultation!

Will & Trust

People have the misconception that wills and trusts are only for those who are wealthy. What most people don’t know is that a will and trust are extremely beneficial for protecting the assets you do have and even your loved ones. A will or a trust should be the main components of every couple’s estate plan, even if they don’t have a large number of assets.

and trust are extremely beneficial for protecting the assets you do have and even your loved ones. A will or a trust should be the main components of every couple’s estate plan, even if they don’t have a large number of assets.

A will is a legal document that expresses a person's wishes as to how their property is to be distributed after their death and which person is to manage the property until its final distribution.

A trust is a legal relationship in which the legal title to property is entrusted to a person or legal entity with a fiduciary duty to hold and use it for another's benefit. With a trust, you can ensure that your assets are transferred to your loved one immediately after you pass away – making it easy for your loved ones.

If you can’t decide between a will or a trust, our team at Estate Law Partners, LLC can analyze your situation and help you determine which one is right for you. Some couples get separate or joint wills. Our team can help you identify which option is most suitable for you.

Durable Power of Attorney

A durable power of attorney is a legal document that gives someone you choose the power to act in your place. For example, if you become incapacitated, a durable power of attorney will give the person you chose the power to make decisions on your behalf. For example, they would handle paying your bills, managing your investments, or directing your medical care.

Choosing a Guardian

Couples who have minor children or are considering having kids should pick a guardian for their children. Choosing a guardian in your will or trust will give you peace of mind, knowing that your children will be with the people you chose in the event that something happens to you and your spouse. The person you should share the same views, be financially responsible, and would genuinely have the will to care for your children.

Beneficiary Designations

There are some assets that can be passed to your beneficiaries without the need for a will or trust (such as your 401(k)). You can also include beneficiary designations in your insurance plans. If you don't name a beneficiary, or if the beneficiary is deceased or unable to serve, a court could be left to decide the fate of your funds.

Letter of Intent

A letter of intent is a document left to your beneficiary. The document will define what you want them to do with a particular asset after your death or incapacitation. Some letters of intent also provide funeral details or other special requests.

Health Care Power of Attorney

A healthcare power of attorney appoints another person (typically a spouse or family member) to make important healthcare decisions on your behalf in the event of incapacity. You should discuss with the person you want to appoint your views and steps you would like to make in the event that you become incapable of making decisions.

Contact our Madison estate planning attorneys today at (608) 292-5185!